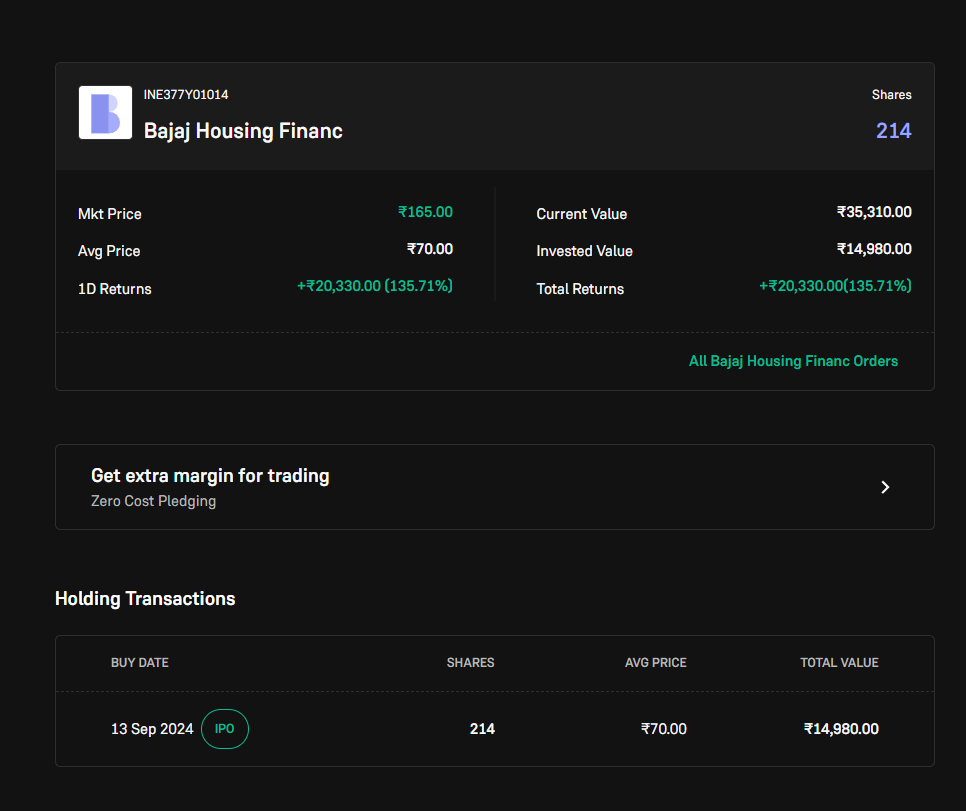

The much-anticipated Bajaj Housing Finance IPO made a blockbuster debut on September 16, 2024, as it hit the upper circuit at ₹165 on both the BSE and NSE, delivering a massive 135.71% return over the issue price of ₹70 per share. The IPO, which had witnessed overwhelming demand during the subscription period, has significantly outperformed market expectations, driven by strong investor interest and robust financial performance.

Listing Performance

Bajaj Housing Finance’s IPO had already created a buzz in the grey market, with the Grey Market Premium (GMP) reaching ₹84 just ahead of the listing. This indicated an estimated listing price of ₹154, but the stock surpassed even the most optimistic projections by hitting the upper circuit at ₹165 within 2 hours of opening. With such a strong debut, investors who were allotted shares saw their investments more than double in a single day.

Key Listing Details:

- Issue Price: ₹70 per share

- Listing Price: ₹150 per share

- Profit Gain: 135.71%

- Upper Circuit: ₹165 per share

Read More: P N Gadgil Jewellers IPO Listing Day: Should You Hold or Sell?

IPO Subscription and Grey Market Buzz

Bajaj Housing Finance IPO was heavily oversubscribed, with an overall subscription rate of 67.43 times, making it one of the most sought-after IPOs of the year. Institutional investors led the charge, with Qualified Institutional Buyers (QIBs) oversubscribing by 222.05 times. The retail portion was oversubscribed 7.41 times, showing immense interest from individual investors.

Grey Market Premium had been rising consistently before the listing, indicating strong demand for the shares. The final GMP stood at ₹84, reflecting an estimated listing price of ₹154. However, the stock outperformed expectations by reaching ₹165, leading to significant listing gains.

Factors Behind the Upper Circuit

Several factors contributed to Bajaj Housing Finance’s strong listing performance and its rapid ascent to the upper circuit:

- Strong Financials: The company reported a 34% increase in revenue and a 38% jump in profit after tax for FY 2024, showcasing robust growth.

- Reputation of Bajaj Group: Being part of the well-established Bajaj Group added credibility to the company, boosting investor confidence.

- High Investor Demand: The IPO was oversubscribed in all categories, with QIBs, retail investors, and non-institutional investors showing keen interest.

- Favorable Market Sentiment: The grey market premium and positive market conditions helped fuel demand for the stock on listing day.

Hold or Sell: What Should Investors Do?

For those who secured allotments, the question remains whether to hold the stock for potential long-term gains or to book profits at these elevated levels. Here’s a breakdown of strategies based on different investment horizons:

- Short-term Traders: Investors looking for immediate profits might consider booking at least partial gains at the current price of ₹165, which has already given a return of over 135%. With the stock hitting the upper circuit, some may choose to sell now and lock in their profits.

- Long-term Investors: For those with a long-term horizon, Bajaj Housing Finance’s solid financial performance, strong industry outlook, and the backing of the Bajaj Group make it a compelling case for holding. The company has demonstrated consistent growth, and its leadership in the housing finance sector positions it well for future expansion. Holding the stock could lead to further gains over time.

Expert Advice

- Understand the Valuation: While the stock’s debut has been stellar, it’s essential to evaluate whether the current valuation aligns with the company’s fundamentals. Investors should consider the company’s future growth potential and compare it with other industry peers.

- Partial Profit Booking: Given the substantial listing gains, many experts advise booking partial profits, allowing investors to secure returns while still holding some shares for potential future growth.

- Avoid Overtrading: Investors should resist the urge to overtrade on listing day, especially given the volatility that can accompany such high-profile IPOs. It’s important to stick to one’s financial goals and avoid rash decisions.