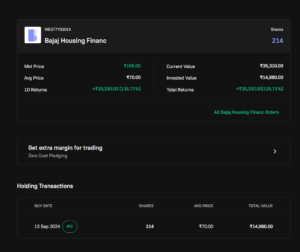

The allotment for Bajaj Housing Finance’s highly anticipated IPO has been finalized, and I am fortunate to have secured two lots. Now, as the listing date approaches on September 16, 2024, the question arises: what should be the next course of action? Let’s explore in this structured guide.

1. Overview of Bajaj Housing Finance IPO

Bajaj Housing Finance IPO saw overwhelming demand, with a total issue size of ₹6,560.00 crores. The IPO consisted of a fresh issue of 50.86 crore shares aggregating to ₹3,560 crores and an offer for sale (OFS) of 42.86 crore shares amounting to ₹3,000 crores.

| IPO Details | Information |

|---|---|

| IPO Date | September 9 – 11, 2024 |

| Issue Price | ₹66 – ₹70 per share |

| Total Issue Size | ₹6,560.00 crores |

| Listing Date | September 16, 2024 |

| Lot Size | 214 Shares |

| Book Running Lead Managers | Kotak Mahindra, Bofa Securities, Axis Capital, Goldman Sachs, SBI Capital Markets, JM Financial, IIFL Securities |

| Registrar | Kfin Technologies Limited |

2. Allotment Details and Listing Date

The allotment was finalized on September 12, 2024. Bajaj Housing Finance IPO will be listed on both BSE and NSE on September 16, 2024. The IPO was oversubscribed by 67.43 times, with retail investors bidding 7.41 times their allocated portion.

| Category | Subscription (Times) |

|---|---|

| QIB | 222.05 |

| NII (HNI) | 43.98 |

| Retail | 7.41 |

| Employee | 2.13 |

3. Listing Day Strategy: Hold or Sell?

One of the critical decisions post-allotment is what to do on the listing day. Should you sell and book profits or hold on for potential long-term gains?

- Grey Market Premium (GMP): As of September 14, 2024, the GMP for Bajaj Housing Finance IPO stands at ₹84, suggesting an expected listing price of ₹154 per share (which represents a 120% gain over the issue price of ₹70).

- Long-term Perspective: Bajaj Housing Finance is part of the well-established Bajaj Group and shows consistent financial growth. With a 34% rise in revenue and a 38% increase in profits over the past year, the company’s long-term outlook remains promising.

| Action | Recommendation |

|---|---|

| On Listing Day | Book partial profits |

| Short-term Traders | Consider selling if the price exceeds ₹150 per share |

| Long-term Investors | Hold for potential future growth |

Read More: Bajaj Housing Finance IPO: GMP Jumps to ₹84 Ahead of Listing

4. Key Financials of Bajaj Housing Finance

The company has shown remarkable growth in the past few years. Below are the key financial figures:

| Financials (₹ Crore) | FY22 | FY23 | FY24 |

|---|---|---|---|

| Revenue | 3,767.13 | 5,665.44 | 7,617.71 |

| Profit After Tax | 709.62 | 1,257.80 | 1,731.22 |

| Total Assets | 48,527.08 | 64,654.14 | 81,827.09 |

Bajaj Housing Finance has grown rapidly, with its profit margins improving and customer base expanding across the country.

5. Expert Tips for IPO Investors

a. Understand the Grey Market Premium (GMP)

While the GMP provides an indication of listing day performance, it’s essential to take a cautious approach. The current GMP suggests a potential 118.57% gain, which may fluctuate based on market conditions.

b. Book Partial Profits

Given the robust GMP and high subscription rates, it might be wise to book partial profits on listing day, especially if the price exceeds ₹150 per share. Retaining some shares could allow for long-term gains if the stock continues to perform well.

c. Evaluate the Long-term Growth Potential

Bajaj Housing Finance’s strong financials, backed by the Bajaj Group, make it an attractive candidate for long-term holding. Investors who prefer stable, long-term returns should consider holding the stock for at least one year.

d. Don’t Overtrade

Resist the temptation to overtrade on listing day. Stick to your financial goals—whether that’s a quick exit or long-term holding.

6. Is It Worth Holding?

In conclusion, Bajaj Housing Finance IPO has performed exceptionally well, with solid demand from investors across all categories. The company’s strong financials, industry growth potential, and backing from the Bajaj Group make it a suitable long-term investment.

For short-term traders, the high GMP indicates an excellent opportunity to book profits on listing day. However, long-term investors may find value in holding the stock, as Bajaj Housing Finance is likely to continue its upward trajectory in the financial sector.