The Bajaj Housing Finance Limited IPO, which concluded its bidding phase on September 11, 2024, has shown significant activity in the grey market post-allotment. Even two days after the allotment was finalized on September 12, 2024, the Grey Market Premium (GMP) continues to rise, signaling strong market interest ahead of its listing on September 16, 2024. Currently, the GMP has hit ₹84, suggesting a potential listing price far above the IPO price band.

Key Details of Bajaj Housing Finance IPO

| IPO Details | Values |

|---|---|

| IPO Price Band | ₹66 to ₹70 per share |

| Issue Size | ₹6,560 crore |

| Fresh Issue | ₹3,560 crore |

| Offer for Sale | ₹3,000 crore |

| IPO Allotment Date | September 12, 2024 |

| Listing Date | September 16, 2024 |

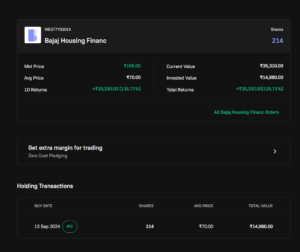

| Minimum Lot Size | 214 shares |

| Market Capitalization (Post IPO) | ₹58,297.03 crore |

| Promoters’ Shareholding (Post IPO) | 87.8% |

| GMP as of 14th September 2024 | ₹84 |

| Estimated Listing Price | ₹154 (120% gain) |

Read Now: Bajaj Housing Finance IPO: Hold or Sell on Listing Day?

GMP Trend for Bajaj Housing Finance IPO

The grey market premium (GMP) for the Bajaj Housing Finance IPO has experienced a steady upward trend over the past few days. Notably, even after the allotment was done on September 12, the GMP surged from ₹78 to ₹84 by September 14, 2024, pointing towards a positive listing performance.

| GMP Date | IPO Price | GMP | Sub2 Sauda Rate | Estimated Listing Price | Last Updated |

|---|---|---|---|---|---|

| 14-09-2024 | 70.00 | ₹84  | 13700/191800 | ₹154 (120%) | 14-Sep-2024 20:27 |

| 13-09-2024 | 70.00 | ₹78.50  | 12800/179200 | ₹148.5 (112.14%) | 13-Sep-2024 23:32 |

| 12-09-2024 (Allotment) | 70.00 | ₹78  | 12700/177800 | ₹148 (111.43%) | 12-Sep-2024 23:32 |

| 11-09-2024 (Close) | 70.00 | ₹74  | 12000/168000 | ₹144 (105.71%) | 11-Sep-2024 23:29 |

| 10-09-2024 | 70.00 | ₹70  | 11400/159600 | ₹140 (100%) | 10-Sep-2024 23:32 |

| 09-09-2024 Open | 70.00 | ₹64  | 10400/145600 | ₹134 (91.43%) | 9-Sep-2024 23:28 |

| 08-09-2024 | 70.00 | ₹56.70  | 9200/128800 | ₹126.7 (81%) | 8-Sep-2024 23:27 |

| 07-09-2024 | 70.00 | ₹52  | 8500/119000 | ₹122 (74.29%) | 7-Sep-2024 23:27 |

| 06-09-2024 | 70.00 | ₹51  | 8300/116200 | ₹121 (72.86%) | 6-Sep-2024 23:26 |

| 05-09-2024 | 70.00 | ₹53  | 8600/120400 | ₹123 (75.71%) | 5-Sep-2024 23:32 |

| 04-09-2024 | 70.00 | ₹50  | 8100/113400 | ₹120 (71.43%) | 4-Sep-2024 23:26 |

| 03-09-2024 | 70.00 | ₹45  | 7300/102200 | ₹115 (64.29%) | 3-Sep-2024 23:30 |

| 02-09-2024 | NA | ₹55.50  | — | ₹55.5 (%) | 2-Sep-2024 23:25 |

| 01-09-2024 | NA | ₹54  | — | ₹54 (%) | 1-Sep-2024 23:29 |

| 31-08-2024 | NA | ₹60  | — | ₹60 (%) | 31-Aug-2024 23:28 |

| 30-08-2024 | NA | ₹55  | — | ₹55 (%) | 30-Aug-2024 23:31 |

| 29-08-2024 | NA | ₹40  | — | ₹40 (%) | 29-Aug-2024 23:28 |

| 28-08-2024 | NA | ₹41  | — | ₹41 (%) | 28-Aug-2024 23:27 |

| 27-08-2024 | NA | ₹41  | — | ₹41 (%) | 27-Aug-2024 23:24 |

| 26-08-2024 | NA | ₹39  | — | ₹39 (%) | 26-Aug-2024 23:31 |

| 25-08-2024 | NA | ₹39  | — | ₹39 (%) | 25-Aug-2024 23:28 |

| 24-08-2024 | NA | ₹39  | — | ₹39 (%) | 24-Aug-2024 23:24 |

| 23-08-2024 | NA | ₹42  | — | ₹42 (%) | 23-Aug-2024 23:30 |

| 22-08-2024 | NA | ₹36  | — | ₹36 (%) | 22-Aug-2024 23:25 |

Why the Rising GMP?

Several factors are contributing to the rising GMP of Bajaj Housing Finance IPO:

- Strong Financials: The company has shown steady growth, with a 34% increase in revenue and a 38% rise in profit after tax in FY 2024.

- Positive Investor Sentiment: With anchor investors investing ₹1,758 crore, the market anticipates strong demand for the stock post-listing.

- Bajaj Group Legacy: As part of the reputed Bajaj Group, the company’s credibility is boosting investor confidence.

- High Subscription Rates: The IPO was oversubscribed 67.43 times, with QIBs oversubscribing by 222.05 times, indicating strong institutional interest.

Investor Implications

The continuous rise in GMP, especially after the allotment, suggests that Bajaj Housing Finance IPO is likely to open at a substantial premium to its issue price. Investors who have secured allotment may enjoy significant listing gains, with the expected listing price around ₹154, reflecting a potential return of over 120%.

However, it’s crucial for investors to remember that while GMP can provide an indication of the market’s sentiment, it is not a guarantee of future performance. Market conditions and demand on the actual listing day will ultimately dictate the listing price.

As of September 14, 2024, the GMP of Bajaj Housing Finance IPO is ₹84, indicating a potential listing price of ₹154.

The GMP is rising due to strong financial performance, high subscription rates, and positive sentiment toward the Bajaj Group’s legacy.

The IPO will be listed on BSE and NSE on September 16, 2024.

Based on the current GMP, investors can expect a gain of approximately 120% upon listing.

The IPO was oversubscribed 67.43 times, with significant demand from QIBs, which subscribed 222.05 times.

The price band for the IPO is set between ₹66 and ₹70 per share.

The company has shown a 34% growth in revenue and a 38% increase in profit after tax for the year ending March 2024.