On the eve of its initial public offering (IPO), Western Carriers reported on Thursday that it has accumulated ₹148 crore from anchor investors.

The company’s exchange filing reveals that it has set aside 85,96,743 shares, valued at the upper price bracket of ₹172, for distribution among 15 anchor investors.

“Prior to the proposed IPO, Western Carriers (India) Limited announced that they’ve successfully secured ₹148 crore. This was accomplished through allocation of 85,96,743 Equity Shares to 15 anchor investors, all priced at the upper band of ₹172 per share (inclusive of a premium of ₹167 per share) and a face value of ₹5 per share,” mentioned in the report.

In the anchor book round, eminent participants included Kotak Mahindra, Motilal Oswal, and Aditya Birla Sun.

Additionally, Western Carriers divulged that of the 85,96,743 total equity shares allocated to the anchor investors, 39,92,952 shares, representing 46.45% of the total pool, were designated for 4 domestic mutual funds. These funds applied through six different schemes.

Details: Western Carriers Initial Public Offering (IPO)

Western Carriers (India) is set to kickstart its much-awaited initial public offering (IPO) from Friday, September 13, which will extend until Wednesday, September 18. This offering will encompass the issue of 2.87 crore shares with a clear aim of garnering around ₹492.88 crore. The specifics include the selling of 0.54 crore shares estimated at ₹92.88 crore and a fresh issue ascending up to 2.33 crore shares, expected to generate ₹400 crore.

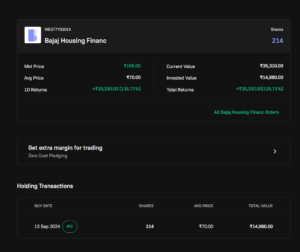

For retail investors, Western Carriers offers the purchase of 87 shares as the minimum quota (one lot), priced anywhere from ₹163 to ₹172 per share. By this scale, the total investment for one lot pegs at ₹14,964, when considering the top price range. A maximum of 13 lots can be acquired by each retail investor.

In terms of allocations, 15% of the total offer is dedicated to non-institutional investors, while 35% is reserved for retail investors. Qualified institutional buyers, on the other hand, receive the lion’s share with 50% of the total offering.

Facilitating the IPO proceedings is Link Intime India Private Ltd as the registrar, whereas JM Financial Limited and Kotak Mahindra Capital Company Limited are serving as the book-running lead managers.

Here’s full Western Carriers IPO details:

| Western Carriers (India) Limited | |

|---|---|

| “*As per SEBI circular no SEBI/HO/CFD/DIL2/CIR/P/2019/76 dated 28 June 28 2019 all are requested to comply with the provisions of the aforementioned circular which states as below: Intermediaries shall retain physical application forms submitted by retail individual investors with UPI as a payment mechanism, for a period of six months and thereafter forward the same to the issuer/ Registrar to Issue. However in case of Electronic forms printouts of such applications need not be retained or sent to the issuer. Intermediaries shall at all times maintain the electronic records relating to such forms for a minimum period of three years.” | |

| Symbol | WCIL |

| Issue Period | 13-Sep-2024 to 18-Sep-2024 |

| Cut-off time for UPI Mandate Confirmation | “18-Sep-2024 (upto 5:00 PM) The new cut-off time for UPI mandate acceptance is 05:00 PM on last day of IPO bidding. Further bids with confirmed status of mandate amount blocked (RC100) shall be considered as valid applications and hence, investors are advised to submit their UPI applications in IPO well in advance to avoid any last minute technical/systemic constraints that may hamper their ability to participate in IPOs by successfully accepting the mandate.” |

| Issue Size | “Initial Public Offer of Fresh Issue of up to Rs. 4000 million Equity Shares and offer for sale of up to 54,00,000 Equity Shares (Including Anchor Allocation 85,96,743 Equity Shares)” |

| Issue Type | 100% Book Building |

| Price Range | Rs. 163 to Rs. 172 per Equity Share |

| Face Value | Re.5 per Equity Share |

| Tick Size | Re.1 |

| Bid Lot | 87 Equity Shares and in multiples thereof |

| Minimum Order Quantity | 87 Equity Shares |

| Maximum Bid Quantity for QIB Investors | “20,868,429 equity shares in multiple of 87 Equity Shares (Calculated at lower Price band)” |

| Maximum Bid Quantity for NIB Investors | “14,969,916 equity shares in multiple of 87 Equity Shares (Calculated at lower Price band)” |

| Maximum Subscription Amount for Retail Investor | “Rs. 2,00,000” |

| IPO Market Timings | 10.00 a.m. to 5.00 p.m. |

| Book Running Lead Managers | JM Financial Limited and Kotak Mahindra Capital Company Limited |

| Sponsor Bank | HDFC Bank Limited and Kotak Mahindra Bank Limited |

| Categories | “FI, IC, MF, FII, OTH, CO, IND and NOH” |

| Sub-Categories applicable for UPI | IND (upto 5 Lakhs) |

| Name of the Registrar | Link Intime India Private Limited |

| Address of the Registrar | “C-101, 1st Floor, 247 Park L.B.S. Marg, Vikhroli West, Mumbai 400 083, Maharashtra, India” |

| Contact person name number and Email id | “Shanti Gopalkrishnan, +91 81 0811 4949, [email protected]” |

| Owner | Rajendra and Kanishka Sethia |